tax loss harvesting rules

Last Updated July 20 2022 544 pm EDT. Tax-loss harvesting is a strategy used to reduce your taxes.

What Is Tax Loss Harvesting Ticker Tape

Financial Planning Tax Planning.

. Rules in Tax Loss Harvesting 1. That means you cant turn around and buy the same security in the 30 days after you sell itif you do the basis is reset and that loss you were trying to get is washed away. The Internal Revenue Service IRS allows single filers and married couples filing jointly to deduct up to 3000 in realized losses from their ordinary income.

One of the most powerful benefits of tax-loss harvesting stems from the fact that after offsetting other capital gains the first 3000 1500 if. The second thing that could be discussed is whether municipal bond funds or ETFs can be tax-loss harvested. To claim a loss on your current years taxes youll have to sell investments in taxable accounts before the calendar year ends and then report the action when you file taxes for the year.

In taxable accounts when you sell a position that has lost value you can use the loss to offset capital gains that result from selling securities at a profit during the year. So set that egg timer and get to work. You also cant buy it in the 30 days BEFORE you sell UNLESS you also sell the shares you just bought.

6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. Your booked losses can. Annual Limit to Harvesting Tax Losses In general tax losses can offset any capital gains that you have.

Tax-Loss Harvesting and Wash Sales How about a deep dive into tax-loss harvesting and wash sales. Its generally done at the end of the year. You need to complete all of your harvesting before the end of the calendar year Dec.

To do it you simply need to lock in a loss by selling the investment position. Not all the rules limit you though. Investors can offset up to 3000 per year and losses can be kept in perpetuity.

The leftover 2000 loss could then be carried forward to offset income in future tax years. Free Case Review Begin Online. To claim a loss for tax purposes.

Tax-loss harvesting cant be used on retirement plans such as 401 k IRAs or other accounts where taxes are deferred. The easiest rule to screw up tax-loss harvesting is the wash sale rule. As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting.

Capital gains tax is the tax on an investments profit once it has been sold. This prevents you from selling and then immediately re-investing to game the system. Use the power of tax-loss carryforwards.

Based On Circumstances You May Already Qualify For Tax Relief. Ad See If You Qualify For IRS Fresh Start Program. Your 25000 loss would offset the full 20000 gain from Investment A meaning youd owe no taxes on the gain and you could use the remaining 5000 loss to offset 3000 of your ordinary income.

But if you want to harvest that tax loss to offset gains you have cannot buy the substantially identical securities within the 30 day period before or after the sale under the wash-sale rule. This rule disallows your loss if you sell a security and purchase a substantially identical security in 30 days or less. Not just the basic rules but the intricacies of what could trigger a wash and how to avoid it and case examples of that.

Learn More At AARP. Ad Browse Discover Thousands of Book Titles for Less. Federal government allows investors to use capital losses to offset capital gains in a current tax year or carry the loss forward into future years.

Tax loss harvesting is really just at the end of the year generally or it can be anytime during the year. Tax Loss Harvesting Top strategies and rules that advisors can consider when using tax loss harvesting to reduce tax. However even if you dont have capital gains to report you can tax loss harvest to lower.

So now that we know what tax harvesting is and how it can help us save on taxes lets discuss two rules to remember so you perform tax harvesting properly. Ad Looking for tax loss harvesting rules. Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end.

Tax-loss harvesting is the process of writing off the losses on your investments in order to claim a tax deduction against your ordinary income. It could be within equities large cap small cap mid cap international emerging markets. Content updated daily for tax loss harvesting rules.

You have a portfolio of various positions that have exposure to any sort of investment area. Follow Tax-Loss Harvesting Rules. That sale creates a tax loss that then.

Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for. Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

However there is no such grace period for tax-loss harvesting. 3000 per year for individual filers or married couples filing jointly or 1500 per person per year if you are married filing separately. That is if your realized net loss on your investments at the end of the year is 5000 you can only deduct up to 3000 from your taxable income for that year but you can also carry forward the unused loss of 2000 to harvest in the future.

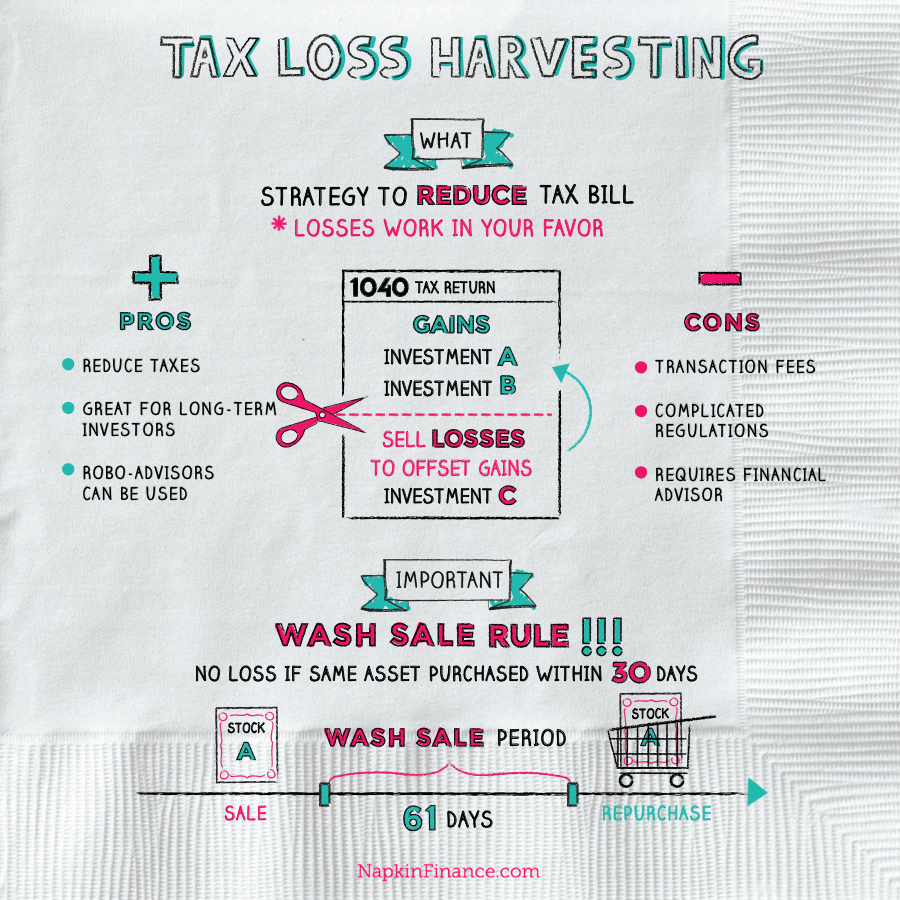

Taxlossharvesting Napkin Finance

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting Everything You Should Know

Top 5 Tax Loss Harvesting Tips Physician On Fire

Turning Losses Into Tax Advantages

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Top 5 Tax Loss Harvesting Tips Physician On Fire

Year Round Tax Loss Harvesting Benefits Onebite

How To Use Tax Loss Harvesting To Lower Your Taxes Ally

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Definition Example How It Works

Reap The Benefits Of Tax Loss Harvesting

How To Tax Loss Harvest At Vanguard With Screenshots White Coat Investor